Extended Producer Responsibility (EPR) regulations, which make producers responsible for the end-of-life management of their products, are not new to the textile industry. However, the regulatory landscape is rapidly evolving, with the European Union at the forefront.

Under the EU Waste Framework Directive, all Member States must have separate textile waste collection in place from January 2025 and fully operational national textile EPR schemes by 2027.

At the same time, textile EPR regulations are emerging globally. California became the first U.S. state to adopt a dedicated textile EPR law, while countries like Switzerland and Australia are exploring voluntary approaches.

This article provides an overview of the existing EPR frameworks for textiles and highlights forthcoming policies worldwide. Let’s dive in!

What Are the Extended Producer Responsibility Requirements for Textiles?

Instead of leaving consumers and the national governments to deal with textile waste, Extended Producer Responsibility schemes place this responsibility on the producers. Fashion brands are held accountable for their products throughout their lifecycle, which includes end-of-life.

Core Requirements for Textile Brands

The specific requirements can vary depending on the country, but they generally include several key elements such as:

- Reporting on the quantities or weight of clothes placed on the market, material type, end-of-life management data, and waste treatment processes.

- Participation in take-back schemes for waste collection.

- Fee payment per unit or weight of textiles placed on the market, which helps fund waste management and recycling systems.

- And lastly, eco-modulation.

Eco-Modulation

Eco-modulation adjusts EPR fees based on product environmental performance. In the textile sector, this typically links fees to ecodesign-related criteria such as durability, recyclability, and material composition. Products that are easier to reuse or recycle may face lower EPR fees, reflecting lower end-of-life management costs.

Waste Collection and Producer Responsibility Organizations

In practice, most fashion brands meet waste collection obligations by joining a Producer Responsibility Organization (PRO) in each country where textile EPR applies. PROs manage the operational aspects of end-of-life, including collection logistics, sorting, and downstream treatment, and often handle reporting on behalf of their member brands.

In countries where PRO participation is not mandatory, fashion brands may still choose to join one. Without a PRO, fashion brands are typically required to organize and finance their own end-of-life solutions, including waste collection and treatment, which is operationally complex and costly.

EPR for Textiles in the European Union

Let’s have a look at the legal basis of the EU legislation and the individual obligations in the different EU member states.

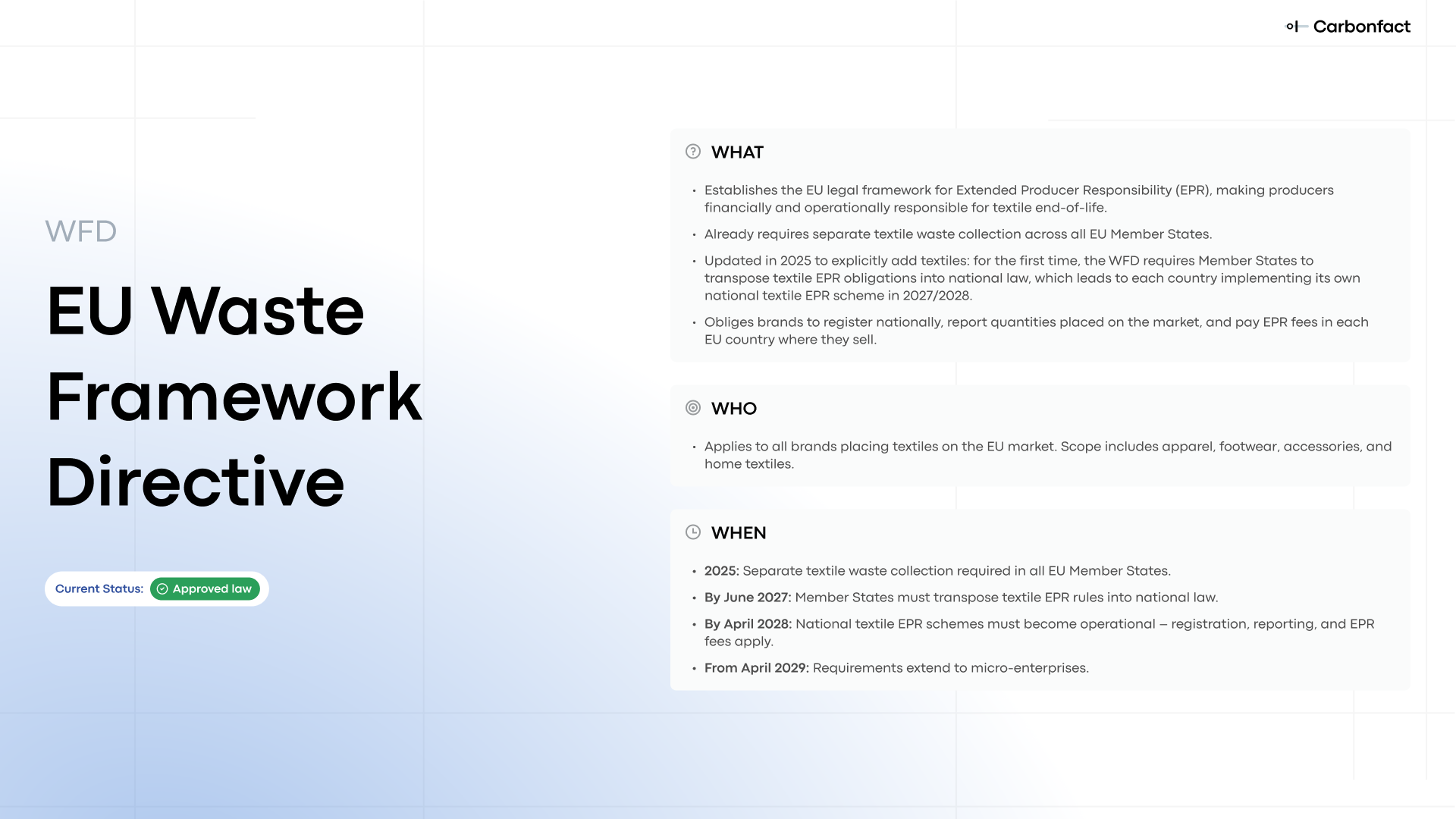

EU Waste Framework Directive: Fashion

Status: ✅ Approved law

The Waste Framework Directive (WFD) was adopted in 2021. A key component of this directive is the EPR, under which Member States must establish their own laws, ensuring producers are responsible for the entire lifecycle of their products.

What Already Applies (Since 2025)

The Waste Framework Directive already requires all the EU Member States to establish separate textile waste collection systems since January, 2025, requiring the separation of textiles from general waste.

What Will Be Required (From 2027)

In 2025, the Directive was formally amended to also introduce the first EU-wide legal framework for textile Extended Producer Responsibility. This targeted revision requires all the EU Member States to establish national textile EPR schemes, making producers financially and operationally responsible for the collection, sorting, and treatment of textile waste.

These new EPR obligations must be transposed into national laws by June 2027, with textile EPR schemes required to be operational shortly thereafter. Under these schemes, brands that place textiles on the EU market will be required to:

- Pay EPR fees to cover the cost of collecting, sorting, reusing, and recycling textile waste.

- Register as textile producers in each EU country where they sell products.

- Report the quantities of textiles placed on the market.

- Comply even if they are non-EU brands selling online to EU customers.

The scope covers clothing, footwear, accessories, and home textiles. The following product categories are included:

Textile Products

- Knitted or crocheted clothing and clothing accessories.

- Non-knitted clothing and clothing accessories.

- Blankets and travelling rugs (excluding electric blankets).

- Bed linen, table linen, toilet linen, and kitchen linen.

- Curtains, drapes, interior blinds, and curtain or bed valances.

- Other furnishing textile articles (excluding mattresses and bedding).

- Worn clothing and other worn textile articles.

- Hats and other headgear made from plaited materials.

- Hats and other headgear made from textile materials, including hairnets.

Non-Textile Apparel & Footwear

- Leather clothing and accessories.

- Waterproof footwear made from rubber or plastics.

- Footwear with rubber/plastic soles and uppers.

- Footwear with leather soles and uppers.

- Footwear with textile uppers.

- Other types of footwear.

Here is a timeline that fashion brands should keep in mind:

- 2025: Separate textile waste collection already in place.

- By June 2027: EU countries must translate the new textile EPR rules into national law.

- By April 2028: Textile EPR schemes must be operational, and fees start applying.

- From 2029: Requirements will also apply to micro-enterprises.

As national textile EPR schemes will require registration, reporting, and fee payments, fashion brands should start preparing now to avoid compliance risks by investing in product and sales data systems, improving material traceability, designing products with durability and recyclability in mind, and setting up or scaling take-back and repair programs.

Several EU countries have already implemented Extended Producer Responsibility regulations:

France – Textile EPR requirements

Status: ✅ Approved law

France was the first country to introduce Extended Producer Responsibility for textiles, with mandatory rules in place since 2007. France’s textile EPR framework is governed under the AGEC law (Anti-Waste for a Circular Economy).

Which Fashion Brands Must Comply

Any brand placing clothing, footwear, or household textiles on the French market must comply, including:

- French brands

- Non-French EU brands

- Non-EU brands selling online to French consumers

Generally, all textile, footwear, and household linen products are included; there are two notable exceptions:

- 100% leather or natural fur garments are not subject to the regulation.

- Products made from 100% upcycled materials that have already contributed through EPR fees are also excluded from the regulation.

You can find the exact list of included product categories here.

Obligations for Textile Brands

Fashion brands must:

- Register with the Producer Responsibility Organization (PRO).

- Annually declare the quantities of products placed on the French market (primarily weight-based, by product category).

- Pay EPR fees to finance collection, sorting, reuse, and recycling.

- Display the Triman Logo and sorting instructions on relevant products, guiding consumers on proper recycling methods.

- Comply with the ban on the destruction of unsold textiles and footwear. Unsold items must instead be reused, donated, repaired, or recycled. Brands are expected to have internal processes or partnerships in place to ensure compliant handling of unsold stock.

Refashion – PRO in France

Refashion is the main Producer Responsibility Organization in France. Fashion brands selling into the French market are required to submit an annual declaration to Refashion (or other PRO), detailing the quantities of clothing, household linen, and footwear they have placed on the French market in the previous year.

Eco-Modulation Fee for Textiles

In France, the EPR fee is the base fee that brands pay when placing textiles, footwear, or household linen on the market. On average, textile EPR fees are around €0.01 per garment, with a maximum of approximately €0.06 per item, depending on the applicable eco-modulation criteria.

France applies eco-modulation through bonuses and penalties linked to product durability, recyclability, and material composition. Eco-modulation adjusts this same fee upward or downward based on product characteristics that affect end-of-life management. These eco-modulated fees have been in force since January 2025.

According to Refashion’s 2025 eco-fee framework, bonuses for eco-design may include:

- Product durability, assessed using technical criteria defined per product category.

- Certification with recognized environmental labels, where accepted under Refashion’s rules.

- Incorporation of recycled raw materials, particularly when sourced from post-consumer textile waste, financed through an approved EPR scheme.

Penalties may apply for:

- Recyclability constraints, such as product designs or components that hinder textile recycling processes.

Eco-modulation is not automatic. Brands must declare eligible products through Refashion’s detailed declaration process and provide supporting documentation via the Refashion extranet.

The Netherlands – Textile EPR requirements

Status: ✅ Approved law

Which Fashion Brands Must Comply

Since July 2023, the Dutch textile EPR applies to newly manufactured:

- Consumer clothing and occupational/workwear.

- Household textiles such as bed linen, table linen, toilet linen, and kitchen linen.

It does not cover footwear, bags, belts, blankets, or curtains under this decree.

It applies to Dutch and foreign companies that first place these textiles on the Dutch market. Foreign companies can comply via an authorized representative (this is a legal representative role; it is not automatically the same thing as a PRO, though a producer organization can sometimes support compliance).

Obligations for Textile Brands

Under the Dutch EPR decree, textile producers must ensure free take-back of used textiles for consumers. In addition, they must make sure that a defined share of the collected textiles is reused or recycled, including a minimum share that is recycled back into new textile fibers.

Here are the targets (weight-based):

- 50% of textiles sold must be prepared for reuse or recycling, increasing gradually to 75% by 2030.

- 10% of textiles sold must be reused within the Netherlands, rising to 15% by 2030.

- 25% of recycled textiles must undergo fiber-to-fiber recycling, with a target of 33% by 2030.

Stichting UPV Textiel – PRO in the Netherlands

Stichting UPV Textiel is the main Producer Responsibility Organization (PRO) for textile EPR in the Netherlands. It supports producers of clothing, workwear, and household textiles in meeting their legal obligations by collectively organizing the collection, reuse, and recycling of discarded textiles.

Brands participating in Stichting UPV Textiel are required to:

- Declare the quantities of textiles placed on the Dutch market (weight-based).

- Contribute financially through EPR fees.

EPR Fee for Textiles

For 2025, Stichting UPV Textiel has communicated a preliminary textile management fee of €0.20 per kilogram, with an offset of €0.08 per kilogram for companies that already participated in 2024. This results in an average fee of approximately €0.12 per kilogram for those companies. Fee levels and invoicing schedules are defined by the PRO and may change annually.

Producers must submit an annual declaration of textiles placed on the market for the previous calendar year. When brands participate in a PRO, reporting is typically handled through the PRO’s systems.

Hungary – Textile EPR requirements

Status: ✅ Approved law

Obligations for Textile Brands

Hungary introduced Extended Producer Responsibility obligations from 2023. Obligated companies must register, keep records, submit quarterly reports, and pay EPR fees based on the weight of products placed on the Hungarian market.

The Hungarian system is operated through MOHU (the national waste management concession company). Producers need to register with MOHU as part of fulfilling their EPR obligations.

Which Fashion Brands Must Comply

The scope of Hungary's Textiles EPR includes apparel, footwear, clothing accessories, household linens, curtains, blankets, and carpets. Obligations apply to both Hungarian and foreign companies.

And, like in the Netherlands, foreign fashion brands can appoint a national authorized representative to fulfill their EPR obligations.

EPR Fee for Textiles

The textile EPR fee started at 145 HUF/kg, but increased to 164 HUF/kg from 2025 (first applying to Q4 2025 market placements).

Since April, 2025, Hungary has tightened enforcement of its textile EPR rules. Companies that fail to submit quarterly reports or pay EPR fees on time face administrative fines, in addition to having to pay any outstanding EPR fees.

Latvia – Textile EPR requirements

Status: ✅ Approved law

Which Fashion Brands Must Comply

Latvia has an active textile Extended Producer Responsibility system, in place since 2022. The system applies to both Latvian and foreign textile companies that place textile products on the Latvian market.

Latvia’s textile EPR applies to clothing, textile-based clothing accessories, household textiles (such as bed linen and towels), curtains, blankets, and footwear.

Core obligations for fashion and textile brands

Latvia operates a dual compliance system. Brands must either:

- Pay the Natural Resource Tax directly to the state.

- Or join an approved Producer Responsibility Organization (PRO), which takes on the waste-management obligations on their behalf.

In practice, most brands choose to comply via a PRO. One of the main PROs in Latvia is called Latvijas Zalais Punkts, abbreviated to LZP.

EPR Fee for Textiles

- Brands that do not join a PRO are subject to a Natural Resource Tax, which is significantly higher (around €0.50 per kg for textiles).

- Fashion companies that join a PRO pay EPR fees set by the PRO, which are substantially lower (vary depending on the PRO).

Fees are calculated based on weight.

Italy – Textile EPR requirements

Status: Proposal (draft decree published; not yet in force)

Italy is preparing to introduce a national Extended Producer Responsibility scheme for textiles. A draft decree was published by the Italian Ministry of the Environment and Energy Security and underwent public consultation in April–May 2025. The final decree has not yet been adopted, and the exact start date is still being finalized.

Which Fashion Brands Would Be Affected

If adopted, Italy’s textile EPR would apply to any company placing covered textile products on the Italian market for the first time, including Italian brands and manufacturers, EU and non-EU brands selling into Italy, importers, and online sellers.

Based on the draft decree, the scope would cover clothing and apparel, footwear, accessories, leather goods, home and household textiles, and mattresses.

Expected Obligations for Textile Brands

If the decree is adopted largely as drafted, producers would be required to:

- Register in a national producer register before placing products on the Italian market.

- Join a collective PRO or operate an approved individual compliance system.

- Pay the EPR fee with applied eco-modulation.

- Report quantities placed on the market and key performance data, such as amounts collected, reused, and recycled.

Timeline

- April–May 2025: Draft decree published for public consultation.

- 2026 (expected): National textile EPR scheme expected to enter into force following adoption of the final decree, though no official confirmed date has been published.

Italy's textile EPR system will likely operate within or in conjunction with the proposed SNET (Sistema Nazionale di Eco Score Tessile) framework, as SNET is the overarching Italian law integrating EPR, eco-scoring (A-E), and fast-fashion penalties.

Spain – Textile EPR requirements

Status: Proposal (draft decree published; not yet in force)

In 2025, the Spanish government published a Draft Royal Decree on textile and footwear waste, which would establish a comprehensive EPR framework once adopted.

Which Fashion Brands Would Be Affected

Under Spain’s draft textile and footwear EPR rules, any company that first places products on the Spanish market will be considered a producer and required to comply.

For brands established outside Spain, the draft requires the appointment of an authorized representative in Spain to fulfill EPR obligations on their behalf.

The draft decree covers a wide range of products, including textile-based apparel, footwear, household and technical textiles, waterproof clothing, leather goods, and certain textile-related accessories. This would make Spain’s textile EPR scope broader than many existing national schemes.

Expected Obligations for Textile Brands

If adopted, the Royal Decree would require brands to:

-

Register with the national Registry of Product Producers.

-

Producers must join or form a Sistema Colectivo de Responsabilidad Ampliada del Productor (SCRAP) to collectively manage waste.

-

Report annually the quantities of products placed on the Spanish market.

-

Finance the full cost of collection, sorting, recycling, and consumer information and awareness initiatives. EPR fees would be eco-modulated.

Only registered producers would be allowed to place covered products on the Spanish market.

Timeline

Final decree approval is expected in 2026 with brands having to register with the Registry of Product Producers shortly after. Actual EPR obligations, like collection/sorting starting later, aligning with the EU Waste Framework Directive.

Non-EU Countries/States With Textile EPR Laws

California – Textile EPR requirements

Status: ✅ Approved bill (implementation phase)

In September 2024, California passed the SB 707 – Responsible Textile Recovery Act, becoming the first U.S. state to introduce a mandatory Extended Producer Responsibility scheme for textiles.

Obligations for Textile Brands

The law requires producers of apparel and textiles sold in California to participate in an approved Producer Responsibility Organization (PRO). The PRO will be responsible for developing and operating a statewide system for the collection, repair, reuse, sorting, and recycling of covered textile products.

Which Fashion Brands Must Comply

Under California’s textile EPR law, the “producer” is the textile company responsible for placing the product on the market. Responsibility follows a clear order:

- The manufacturer of a product who owns or licenses the brand or trademark under which it is sold.

- The brand owner or exclusive licensee, if no such manufacturer exists in California.

- The importer of a product if neither the manufacturer nor the licensee are present.

- If none of the above are present in the state, the distributor, retailer, or wholesaler selling the product is responsible.

California’s textile EPR applies to apparel, footwear, and other textile products sold in the state. Detailed product scope and exclusions will be clarified through implementing regulations and PRO plans. In short:

- The law (SB 707) says what must exist.

- Implementing regulations will lay out how the law works in detail.

- PRO plans say how producers will meet the requirements.

Timeline

SB 707 is implemented in phases:

- By January 1, 2026: PRO must submit a detailed plan to the state explaining how it will run the textile EPR system, including how products will be collected, reused, repaired, recycled, funded, and reported, for state approval.

- By July 1, 2026: Textile producers must participate in an approved PRO once a plan is approved.

- Following approval: The system is rolled out progressively, in line with approved plans.

Producers that fail to comply with SB 707 may be subject to penalties, which can reach:

- Up to $10,000 per day.

- And up to $50,000 per day for intentional or repeated violations.

New York – Textile EPR requirements

Status: Proposal

New York is considering a textile Extended Producer Responsibility (EPR) framework through Senate Bill S3217, introduced in January 2025. The bill is not yet law, and no obligations currently apply.

Expected Obligations for Textile Brands

If adopted, the bill would require textile producers to:

- Finance and manage end-of-life treatment for textile products sold in New York.

- Participate in a collective collection system (PRO) or operate an approved individual system.

- Provide free and convenient take-back options for consumers.

- Report annually on the amount of textile waste collected (by weight), how it was treated (reuse, recycling, disposal), and whether the collection program met its targets.

Timeline

If the bill is enacted:

- By 31 December 2026: Producers must submit a collection program plan to the state, individually or through a representative organization.

- By 1 July 2027: Producers must implement or participate in an approved textile collection system.

- After this date, covered products could not be sold in New York unless the producer is compliant.

Washington – Textile EPR requirements

Status: Proposal

Washington is developing a comprehensive Extended Producer Responsibility (EPR) framework for apparel and textile products through House Bill 1420.

Which Fashion Brands Would Be Affected

“Producers” include brand owners, manufacturers, importers, and – if none are established in the state – retailers or distributors selling apparel or textile products in Washington. Secondhand-only sellers and companies with less than $1 million in global annual turnover are exempt.

Expected Obligations for Textile Brands

The proposed law would apply to apparel, footwear, and other consumer textile products sold in Washington. If the law is enacted, producers would be required to:

- Join an approved Producer Responsibility Organization (PRO) or register as an individual PRO.

- Support a free and convenient statewide textile collection system, including permanent drop-off points and mail-back options.

- Pay eco-modulated fees, where products designed for durability, reuse, and recyclability face lower fees.

- Report annually on products sold, quantities collected, reuse and recycling outcomes, and program performance.

Fashion retailers, distributors, and online marketplaces would be prohibited from selling covered products unless the producer is listed as compliant.

Timeline

Here is a timeline fashion brands should keep in mind in case the law is adopted:

- By January 2027: Producers should register or join a PRO.

- By January 2029: PRO plan submitted for state approval.

- From April 2031: Approved plans begin implementation.

Switzerland – Textile EPR requirements

Status: Voluntary

Fabric Loop, founded by ODLO, Swiss Textiles, and other industry stakeholders, is inviting additional companies to join a collective, industry-led initiative to establish a voluntary textile take-back and recycling system in Switzerland.

Swiss authorities have indicated that regulatory intervention could follow if the industry does not develop an effective solution for textile waste management. By joining Fabric Loop, brands can help shape a harmonized, practical approach aligned with industry needs.

Australia – Textile EPR requirements

Status: Voluntary

Australia currently operates a voluntary EPR program, known as the Seamless Clothing Stewardship Scheme, which became active in 2024. However, the government has stated that if participation by textile companies remains low, it will move to make the program mandatory. The scheme aims to achieve clothing circularity and reduce 200,000 tons of annual textile waste in Australia by 2030.

The scheme asks textile companies to impose a small per-item fee to fund programs that foster the design of more durable and recyclable clothing. It will also help finance the expansion of the textiles collection, sorting, and recycling infrastructure.

Emerging Textile EPR Frameworks

Beyond the countries where textile EPR schemes are adopted or the proposal is already drafted, many additional countries have it on their agenda.

In the European Union, the direction is now clear: under the revised Waste Framework Directive, all Member States must have fully operational textile EPR schemes by 2027. This means that countries that do not yet have national systems in place are currently drafting legislation or preparing administrative frameworks to comply with this requirement.

Norway, while not an EU Member State, is expected to align with EU textile waste requirements through its participation in the European Economic Area, with national implementation under development.

The United Kingdom currently has no textile EPR scheme in place. While textile waste has been identified as a policy issue and EPR has been discussed, no draft legislation or implementation timeline has been published.

Textile EPR schemes are not yet fully in force in South America, except in Chile, where textiles were declared a priority product under the national EPR framework in 2025. In Asia, South Korea applies mandatory recycling and textile recovery targets under its Resource Circulation Framework, while Japan relies on voluntary, industry-led initiatives rather than formal textile EPR legislation.

Simplify EPR Compliance With Carbonfact

Extended Producer Responsibility (EPR) reporting presents a significant challenge for brands, not only because of the administrative burden – gathering accurate data is also a complex endeavor. Many brands struggle to determine the weights of product components, identify fiber compositions, and link this product data to sales data for reporting purposes.

How Carbonfact Helps

Carbonfact transforms this challenge into an opportunity by providing tools that streamline EPR compliance while driving cost savings and impact reductions. Here's how:

- Link product and sales data: Our platform connects your product specifications - including detailed fiber compositions and component weights - with sales data, ensuring accurate and complete EPR reporting.

- Reduce costs with ecodesign: Carbonfact’s eco-design tools allow you to analyze your product portfolio for the amount of recycled material used. This can lead to substantial cost savings through eco-modulation, where products with higher recyclability incur lower EPR fees as you optimize your product range.

Why Act Now?

EPR isn’t just about reporting – it’s about aligning with the market shift toward circularity. Carbonfact equips you with the data, insights, and tools to not only meet compliance requirements but also create significant cost savings through eco-modulation.

Lidia Lüttin

Lidia Lüttin